When Hope and History Rhyme

By Sehr Khaliq, Director of Program Evaluation

Forty years ago in the spring of 1985, when student protestors in all parts of the U.S. consistently demanded that U.S. colleges and universities divest their holdings in U.S. companies doing business in apartheid South Africa, they were joined by a number of faith communities. These faith-based investors, many of whom were the founding members of ICCR, were responding to a call to action from South African anti-apartheid faith leaders who called on churches and faiths to “radically revise” their investment policies because their investment in apartheid South Africa were not an apolitical act and their money had “largely been used to support the prevailing patterns of power and privilege“. This recognition that money is not neutral continues to inform investment stewardship programs and investor engagement with not only companies, but also asset managers.

In the last few months, we have seen several asset owners hold their managers accountable on stewardship concerns. In February 2025, The People’s Pension, one of the UK’s largest defined contribution master trusts with more than £30B in assets, cut back on its investments with U.S. manager State Street, citing misalignment on climate stewardship as one of the factors influencing the decision. A month later in March, AkademikerPension a Danish pension fund and ICCR member announced it was also scaling back its investments in State Street on stewardship concerns. In April, New York City Comptroller Brad Lander announced that the Teachers’ Retirement System (TRS), New York City Employees’ Retirement System (NYCERS) and Board of Education Retirement System (BERS) had instructed their public markets asset managers to submit a written plan describing their net zero plans, by June 30. And then in June Dutch pension fund PME issued a blanket warning to U.S. money managers amid concerns America’s investment industry is caving in to political pressure to abandon basic principles of stewardship.

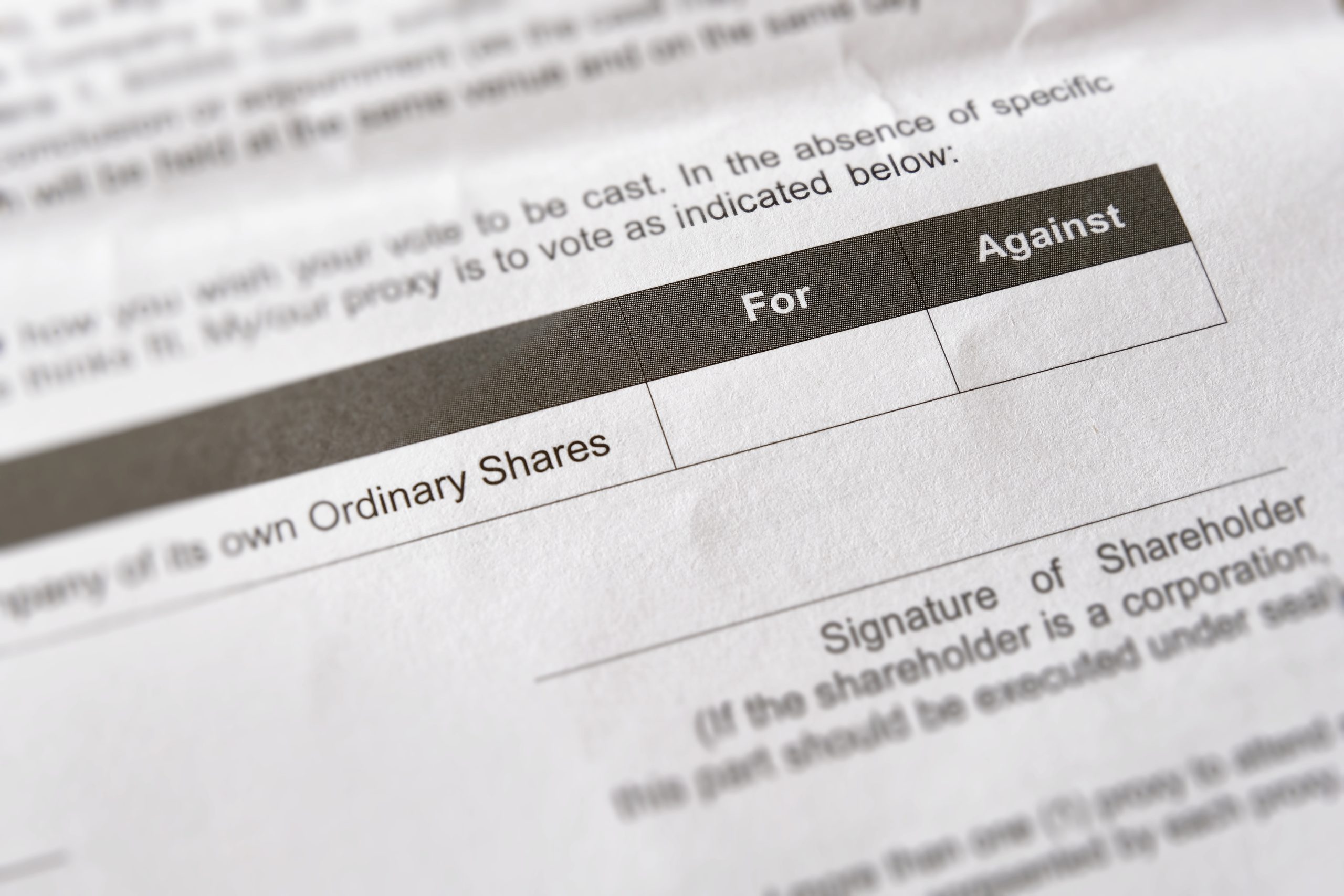

ICCR and its members have been actively and publicly engaging their managers on proxy voting and stewardship. In April 2023, ICCR wrote to eight asset managers (see letters embedded in press release), highlighting concerns about their 2022 proxy voting on environmental and social shareholder resolutions. A number of ICCR members also wrote to these asset managers in support of the ICCR letters as clients and/or shareholders. Over the course of the summer of 2023, several of these firms responded to the letters and organized dialogues with ICCR members. However, the dialogues and the 2023 proxy voting record of these asset managers only increased asset owners’ concerns. In December 2023 some ICCR members decided to take these concerns to proxy by filing shareholder resolutions at BlackRock, State Street, Goldman Sachs and JPMorganChase challenging these asset managers on their poor voting records and urging them to evaluate misalignments between their public commitments on climate and racial justice, and their proxy voting records in 2024. In December 2024, ICCR members wrote to four of the largest global fund managers – which collectively manage roughly $23.6T in assets representing nearly one-quarter of global capital markets – as clients, highlighting contradictions created by the asset managers’ dramatically declining proxy support for shareholder proposals despite their public commitments to sustainability, particularly commitments to mitigate climate risk.

But ICCR members are not alone in these engagements. In April the Committee on Workers’ Capital mobilized 20 global asset owner representatives – with a combined assets under management (AUM) of nearly $1.8T – to engage with BlackRock to articulate their expectations around the managers’ approach to labor rights stewardship. Also in April, pension fund members of the Ethos Engagement Pool (EEP) International, comprising 122 institutional investors representing more than 1.5 million insured people and CHF 300B in AUM, decided to engage in a constructive dialogue with their main asset managers to ensure that their voting rights at the general meetings of the companies in which they invest are exercised in accordance with their wishes and sensitivities. There is a growing belief that the current political climate is stimulating a rebalancing of power between institutional investors and asset managers and pension funds are increasingly leveraging their position as clients.

ICCR’s history of successful shareholder engagement offers countless examples of the value of collaborative investor action and arguably puts ICCR in a unique position to leverage this shared history to mobilize asset owners to engage not just companies but asset managers on environmental, social and governance (ESG) risks. Many agree that this is both a societal and a business imperative for asset managers, whose own research indicates that funds are finding it “increasingly difficult” to market products that are not registered as “ESG”, and this trend is likely to persist and strengthen.

If you want to learn more about ICCR’s work on engaging asset managers on ESG risks please connect with Tim Smith, Senior Policy Advisor, ICCR at tsmith@iccr.org.