ICCR Members Help Lead Advocacy Day in Congress to Protect Our Rights to File Shareholder Resolutions

By Tim Smith

ICCR and its members have consistently understood the need to have our voices heard on important policy issues related to our work. From the Securities and Exchange Commission to Congress, we understand the importance of advocating for our values around the crafting of public policy.

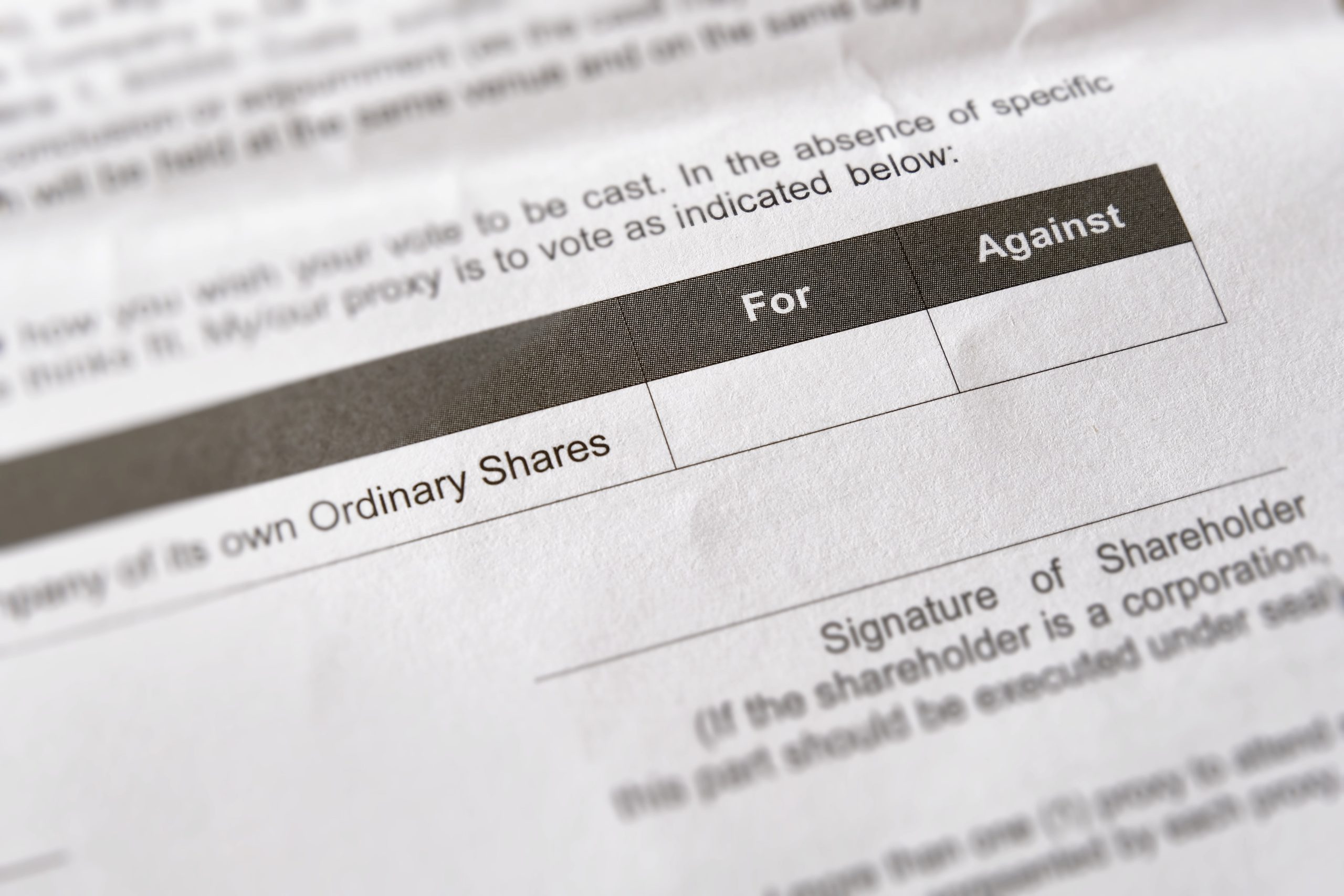

At this moment there are significant and growing attacks on the rights of shareowners coming from certain states, members of Congress and the SEC. Those attacks are currently focused on on the rights of shareowners to file resolutions and to engage companies on ESG issues. Responding to these attacks, ICCR and other investor organizations like Ceres and USSIF convened an Advocacy Day in Washington DC on September 16th. The group that convened included approximately 45 investors and investor organizations that visited 39 offices, eager to discuss the challenges we face regarding the proxy rules and shareholder resolutions.

Visits were made to the offices of 25 Democrats and 14 Republicans — 25 members in the House and 14 members of the Senate. Meetings with Democratic offices, which were generally sympathetic, encouraged those members and their staff to step up and respond to these attacks with us. In discussions with Republican offices, we stressed that these attacks undercut the rights of shareowners to engage the managements of companies they invest in and the need to protect our rights within the free enterprise system.

Religious investors were a strong voice in the delegations. Four ICCR staff were included along with representatives from CBIS, IASJ, Mercy Investment Services, the Disciples of Christ, Evangelical Lutheran Church in America, Friends Fiduciary, Sisters of Saint Joseph of Peace. Other members included the AIDS Foundation, Azzad Asset Management, Zevin Asset Management and Loring Wolcott and Coolidge.

The voice of faith-based investors was particularly important in these debates. Critics have argued that the proxy process has been hijacked by left wing activists who are advancing issues with companies that have nothing to do with the bottom line and their business success. When we met with staff of the House Financial Services Committee, our delegation made clear that this was a gross misrepresentation of the advocacy in place for over 50 years. The representative from the Disciples of Christ, who was President of their foundation, noted that their advocacy was done as part of their fiduciary duty as well as reflecting their faith and values, and noted the Disciples of Christ have been filing resolutions with companies for over 50 years.

The week before, during House Financial Services Committee hearings which lasted 4 hours, attendees of that hearing were subjected to a long list of attacks on shareholder resolutions and the issues being raised through the proxy process. In response, the team of investors leading these meetings stressed how issues raised through the proxy process raise questions of risk for companies that have a definite impact on the bottom line and emphasized it is their fiduciary duty to address these kinds of risks that could have a negative impact on their portfolios.

Encouraged by the effectiveness of this Advocacy Day, its organizers have recommended that we have another such day in April 2026. In addition, ICCR has regularly encouraged members to persist in advocating forcefully with members of Congress, especially as the attacks on our work expand and the SEC continues its plans to limit the ability of investors to file resolutions. ICCR has also encouraged members to continue to send letters to their members of Congress highlighting the importance of standing up for the ability of share owners to engage companies in their portfolios.

This advocacy will inevitably need to continue and expand.