Faith-Based Investors and Other Institutional Shareholders Push Back on ESG

For over 50 years, the Interfaith Center of Corporate Responsibility has engaged companies on ESG risk.

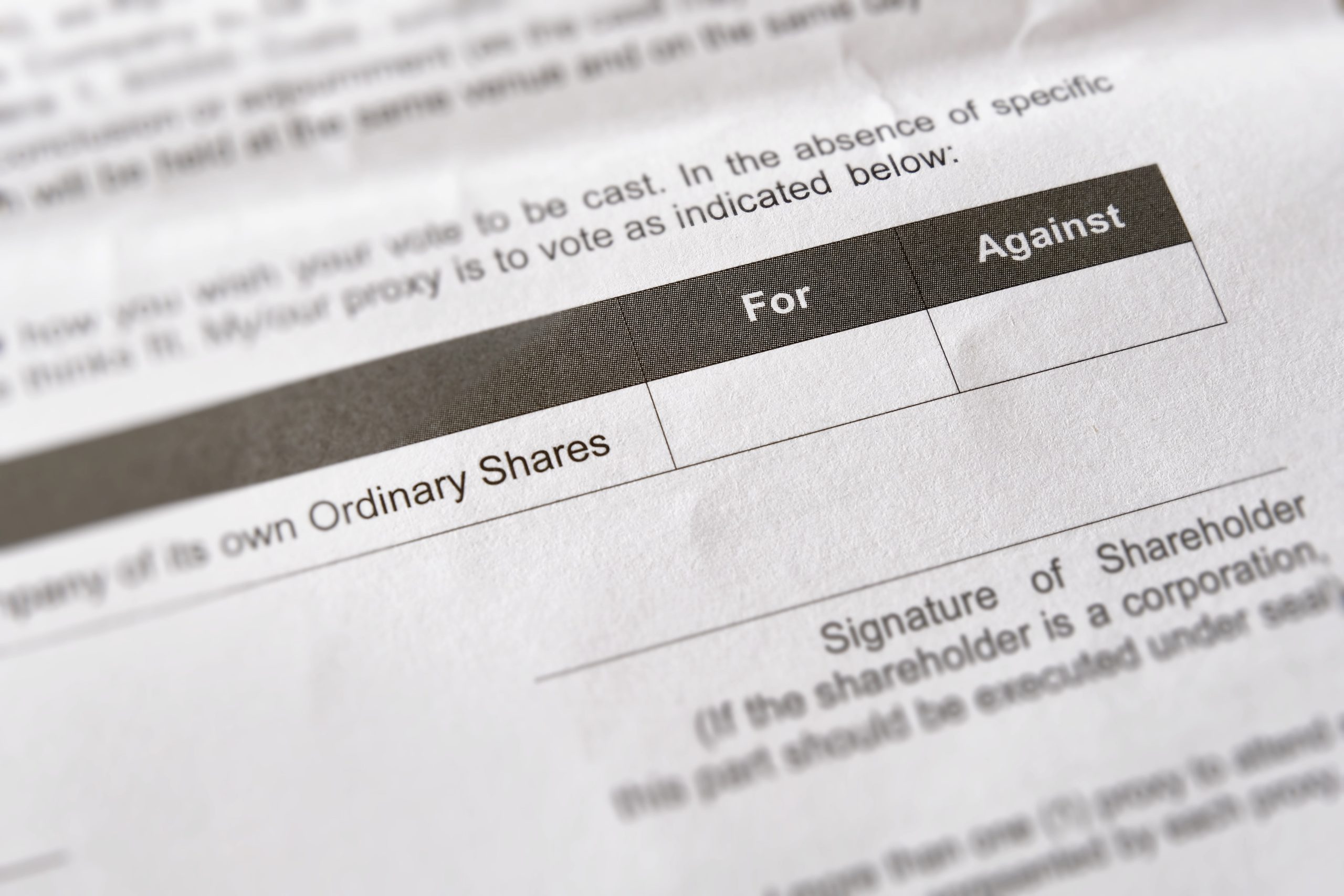

The Interfaith Center on Corporate Responsibility plays a special role in the ongoing dialogues between companies and their investors. Born from a 1971 campaign to divest assets from apartheid South Africa, ICCR’s members, today, conduct active dialogues—engagements, in industry parlance—with companies about an array of environmental, social, and governance risks. They do so either behind the scenes or by filing shareholder resolutions, also known as proxy-voting proposals, all the while insisting on the language of fiduciary duty. The membership, about half of which is faith-based, also straddles the craggy divide between values and fiduciary responsibilities that’s a characteristic of sustainable investing. “For over five decades, the ICCR has shaped the practice of investor advocacy, working to protect the human, ecosystems, and financial capitals that underpin resilient markets,” says Jackie Cook, senior director within Morningstar Sustainalytics’ stewardship service.