ICCR Response to SEC Chair Atkins’ Speech on Shareholder Proposals

In remarks last week before the John L. Weinberg Center for Corporate Governance, SEC Chair Paul Atkins made it clear he would support an effort to strip rights away from investors through limiting their ability to submit shareholder proposals. This proposed change would upend 80 years of precedent at the SEC and in corporate governance in the United States and immediately set off alarms throughout the investment community. ICCR released the following statement responding to the SEC Chair’s remarks:

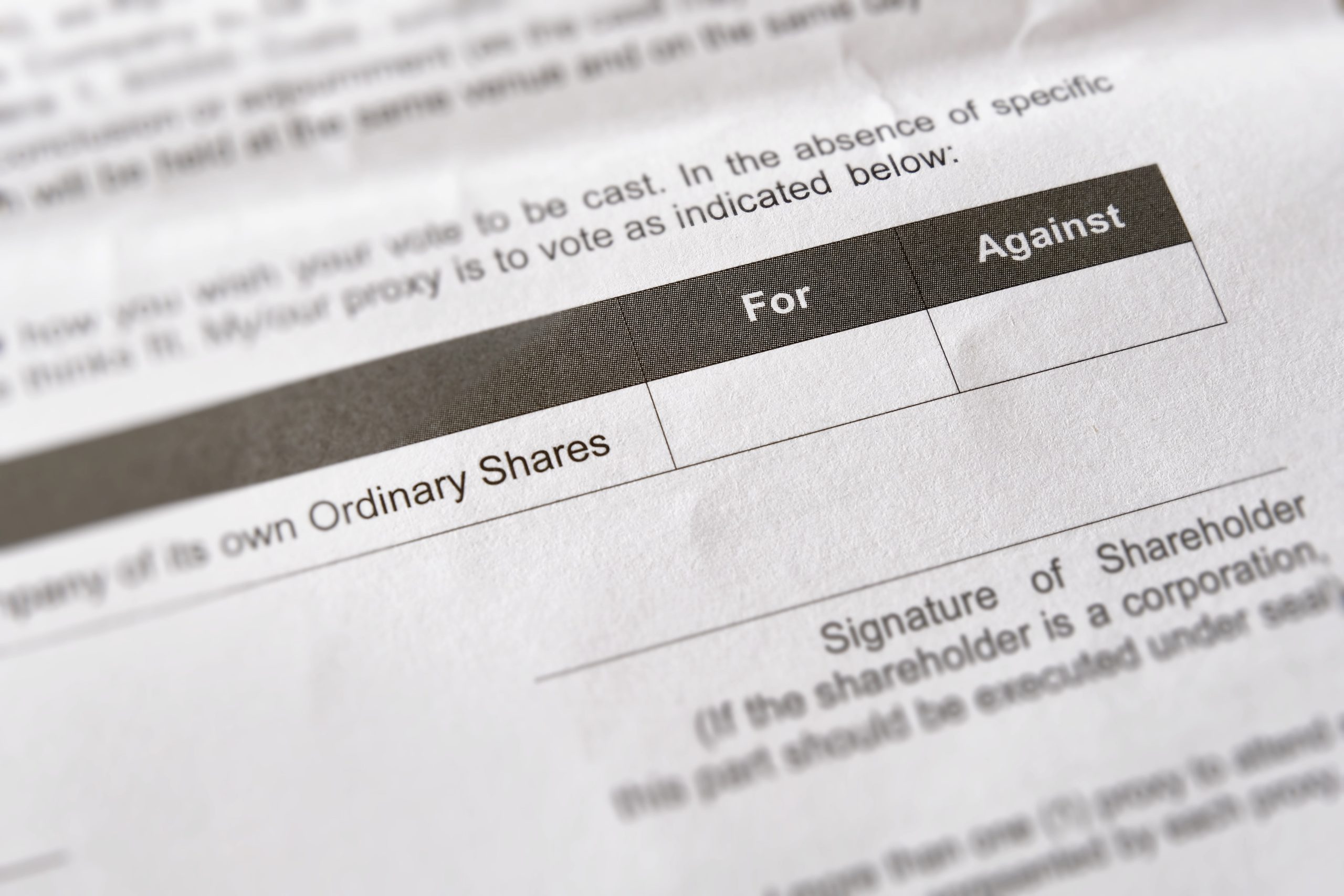

“ICCR is deeply concerned with the October 9 speech from SEC Chair Paul Atkins at the Weinberg Center for Corporate Governance, in which he essentially suggested a ‘road-map’ to issuers to remove any non-binding shareholder proposal from the corporate proxy. This idea, if implemented by the SEC without any public input, would be a radical and short-sighted departure from more than 80 years of precedent in which shareholder proposals have been a critical tool in a private ordering process that has led to important improvements in corporate governance, and corporate policies and practices, that have benefited both companies and investors. This long-standing process has given generations of American investors greater voice and power and in turn helped build a stronger and more dynamic economy, safeguarding the investments that millions of American families depend upon.

At a time of growing unease about the condition and direction of the U.S. economy, Chair Atkins should be seeking to strengthen rather than undermine investor protections, particularly given his agency’s investor protection mandate. In the weeks ahead, it is crucial for shareholders and their allies to speak out forcefully against this proposal to change 80 years of precedent supporting the rights of shareholders to file resolutions with companies, further weakening accountability at every level.”