Investor Groups Release Report Defending Shareholder Proposal Rights Against Threats

NEW YORK, NY, MONDAY, FEBRUARY 24, 2025 – Today, three investor groups released a report, Shareholder Proposals: An Essential Investor Right, in response to threats to fundamental shareholder rights that underpin capital markets from Congress, the courts, and the Securities and Exchange Commission (SEC). Shareholder proposals enable investors to safeguard their portfolios and protect the American public by holding corporate boards and management accountable for mismanagement and egregious conduct. The groups issuing the report include the Interfaith Center on Corporate Responsibility (ICCR), the Shareholder Rights Group, and US SIF.

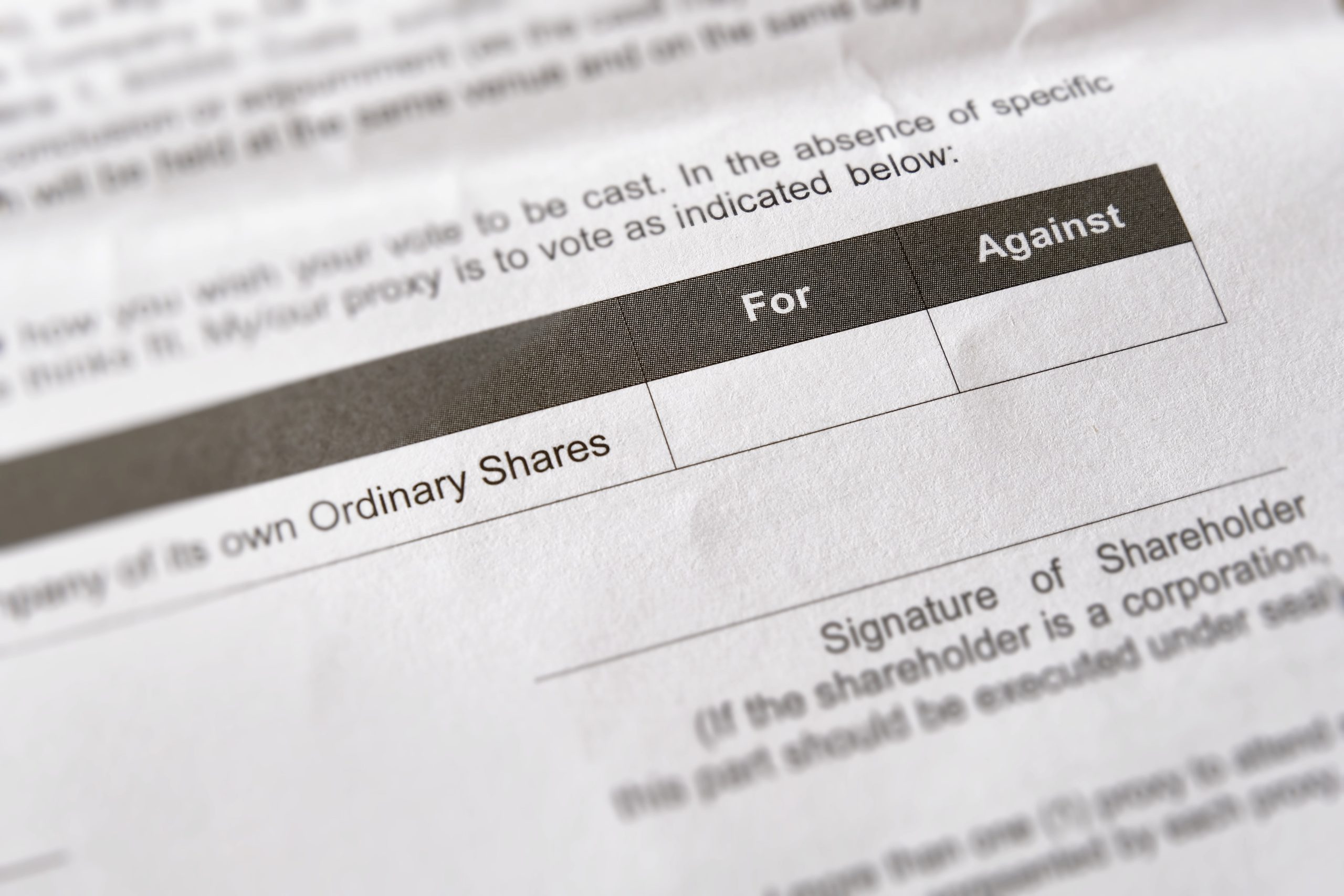

Shareholder proposals typically address risks to companies and investments, such as potential lawsuits, operational disruptions from droughts, floods and fires, and ethical concerns that may shake consumer or investor confidence. The investor right to file proposals on these issues has recently come under attack from legislation in Congress and lawsuits filed in the federal courts in Texas. Shareholder proposals have also been in the regulatory crosshairs. New SEC staff guidance issued on February 12 threatens to penalize shareholders who have filed proposals based on prior guidance, according to an investor letter sent to SEC Acting Chair Mark T. Uyeda. New staff guidance issued on February 11 regarding Beneficial Ownership Reporting appears to discourage investors holding more than 5% of a company’s voting shares from engaging with those companies to address concerns with the threat to vote against board members. It makes filing and voting on shareholder proposals an important alternative pathway to engage with their investee companies.

This new report documents how shareholder proposals have benefitted investors and the public through corporate accountability on an array of issues such as excessive drug pricing by pharmaceutical companies, railroad safety, online child safety at tech companies, and oversight of addictive opioids by manufacturers. It also spotlights improvements in corporate governance such as annual board elections, independent directors, and majority voting. that have occurred from decades of shareholder proposals led largely by a dedicated group of individual investors seeking structural changes at corporations to improve board and management accountability.

“ICCR and its members have been regularly engaging their portfolio companies to strengthen corporate governance and address long-term risks for over 50 years and have often used shareholder resolutions as a critical tool to facilitate dialogue with companies,” said Josh Zinner, CEO of the Interfaith Center on Corporate Responsibility. “At present, the fundamental right of shareholders to access the proxy process is under unprecedented attack at multiple levels and by multiple parties. This publication is a detailed and thoughtful defense of shareholder proposals along with descriptions of some of the many positive corporate changes they have helped catalyze.”

“Investors across capital markets value shareholder engagement and the shareholder proposal process even when they are not filing the proposals,” said Bryan McGannon, Managing Director of US SIF: The Sustainable Investment Forum. “Shareholder advocacy and corporate engagement are pivotal strategies for fostering sustainability factor alignment and risk mitigation. This report explains and lays out a clear case for a robust process that ensures shareholder rights.”

James McRitchie, Shareholder Advocate, Corporate Governance said “Markets continuously evolve. Shareholder proposals play a critical role in defining what reasonable investors consider financially material. That information is crucial in mitigating risks and allocating capital to its best use.”

“This report is a timely message to set the record straight and to defend an essential investor right. Shareholder proposals can create a powerful public platform for challenging and improving corporate policies, practices, performance, and impacts. They are an effective and efficient tool that can help companies understand and address key governance, social, and environmental challenges. Finally, they provide an important mechanism for surfacing investor perspectives, which can benefit management, the board, and other shareholders,” said Jonas D. Kron, Chief Advocacy Officer, Trillium Asset Management.

Julie Goodridge, Founder and CEO of NorthStar Asset Management said, “At NorthStar Asset Management, we consider it our fiduciary duty to actively engage with companies within our portfolio to improve their standing on all issues that impact communities, shareholders, and profits. Shareholder proposals and engagement have been an essential tool for NorthStar to protect clients’ investments and an integral part of our investment process. We file shareholder proposals with the goals of protecting communities, encouraging better corporate behavior, and exposing unseen risk.”

CONTACTS:

Susana McDermott

Director of Communications

Interfaith Center on Corporate Responsibility (ICCR)

201-417-9060 (mobile)

smcdermott@iccr.org

Sanford Lewis

Director & General Counsel

Shareholder Rights Group

(413) 461-2988

sanfordlewis@gmail.com

Bryan McGannon

Managing Director

US SIF

(202) 872-5359

bmcgannon@ussif.org

About the Interfaith Center on Corporate Responsibility (ICCR)

The Interfaith Center on Corporate Responsibility (ICCR) is a broad coalition of more than 300 institutional investors collectively representing over $4 trillion in invested capital. ICCR members, a cross-section of faith-based investors, asset managers, pension funds, foundations, and other long-term institutional investors, have over 50 years of experience engaging with companies on environmental, social, and governance (“ESG”) issues that are critical to long-term value creation. ICCR members engage hundreds of corporations annually in an effort to foster greater corporate accountability. Visit our website www.iccr.org and follow us on LinkedIn, Bsky and X.

About the Shareholder Rights Group

The Shareholder Rights Group is an association of investors formed to defend the shareowner’s right to engage with public companies on governance, corporate accountability and long-term value creation. Visit our website at www.shareholderrightsgroup.com.

About US SIF

US SIF works to ensure that the US capital markets play an active role in driving investments toward more sustainable and equitable outcomes. The US SIF and its members are the leading voices of sustainable investment. We aim to create a level playing field in Capital Markets which includes increased transparency and disclosure across the industry. US SIF’s 200+ Members represent trillions in assets under management. The Membership includes actors across the entire capital markets value chain—including asset owners, financial advisors, asset managers, institutional investors, community investment institutions and data & service providers. Visit our website at www.ussif.org.